Sales & Marketing

DafriBank: A Mission To Revolutionize African Banking Services

DafriBank is transforming the old commercial banking systems with its revolutionary Digital Banking model. It opens new opportunities for the rising African digital entrepreneurs, an oft-ignored niche. This digital-only bank is projected to begin operation in the third quarter of 2021 and will have physical presence in Nigeria and South Africa, and envisions expanding to Kenya, Botswana, and Ghana, amongst more.

The bank uses advanced technologies that will allow access to a wide range of financial services without entry barriers. It will house the best digital banking systems providing payment solutions to an array of businesses and platforms. DafriBank lives up to its promise to open up new opportunities to the African population through future-centric ideals that centres on achieving an economically liberated continent.

With its disruptive technology DafriBank aims to push the boundaries in the African banking community to offer top-class digital banking services that will help many companies uncover the real value of their businesses. DafriBank’s primary focus will be to serve the unbanked and underbanked who have been unjustly excluded from the global financial systems due to several factors.

Poverty and lack of resources are chief amongst the issues impacting the banking system in Africa today culminating in the lack of sustainable banking solutions that meet the people’s needs. Some important factors that influence bricks and mortar banks are cost and lease, staff salaries, employee training, cash distribution costs, and the plethora of other expenses that has made it near impossible to offer cost-effective services to customers who have been forced to seek out alternatives.

Alternative local online payment solutions have also repeatedly failed its African customers especially Digital Afripreneurs by ignoring and denying them efficient solutions that could help take their businesses to greater heights and harness their potential. This is counterintuitive considering Africans are huge players in the Digital entrepreneurship niche that is witnessing astronomical growth and sprouting opportunities across many sectors including e-commerce, Forex trading, brokerage business, binary options, stock market, soccer betting, digital exchange, digital marketing, social media marketing, e-magazines, online publishing, blogging, Airbnb, and a plethora of more businesses.

These platforms have overtaken non-digital businesses and are contributing massively to the economy. It’s startling to know that banks and financial institutions continue to underserve African players in this multi-billion-dollar industry. This has led many new-age entrepreneurs to try out alternative payment solutions such as Apple Pay, PayPal, Payoneer, Skrill, and more. Though, these gateways are not in sync with the African market due to their exorbitant transaction fees and several restrictions. Case in point: PayPal denies many African countries full access to its transfer and withdrawal functionalities, leaving many African businesses unable to attract prospects in many regions.

DafriBank, with its unique financial solutions targeted at Africans embrace cutting-edge technology and models as tools to effectively streamline banking processes, making it accessible to everyone and elevating the user experience. The company strives not just to create solutions for the wealthy but also for the average African. DafriBank’s digital bank represents an ultramodern financial boutique that unites several services ranging from traditional banking services including savings, deposits, payments, and loans to niche services such as cross-border remittances; all of which will be offered at competitive rates with speed, ease-of-access, and bank-grade security at the heart of its operations.

The eagerly awaited digital – entrepreneurial class choice platform which has been dubbed “the Chime of Africa ” is a subsidiary of DafriGroup PLC, a multinational conglomerate headed by a renewed South African philanthropist/businessman, Xolane Ndhlovu, who is the fomer Chief Executive Officer of UMEH Group Ltd. DafriBank is assembling a team of outstanding professionals and thought leaders across several fields. It recently announced its new Chief Executive Officer Ramswamy Easwara, a versatile award-winning banker with more than 18 years of experience in the banking sector across multiple roles previously held in several leading financial institutions.

Easwara told reporters, “Our success will be largely based on a product of our client-base. Once a customer believes that there is value derived from our business they will come to us”, he said. “Growth will definitely be subdued because of the economic downside caused by Covid-19, but in the long term the potential is massive and will present investment opportunities. From a banking perspective, we mirror the economy. When the economy is under pressure, it resonates in the financial system. We are committed to looking at innovative ways to gain even more market share,” He added.

The bank is confident about its future growth and sustainability under its expert leadership.

Indeed, DafriBank is a dream come true for countless Africans who are eagerly anticipating its launch in the 3rd Quarter of 2021.

A bright new dawn in Africa’s banking services is here.

Sales & Marketing

Innovative Blank Apparel Customization

Blank apparel offers a versatile canvas for creativity and personalization, allowing individuals and businesses to create unique and stylish garments. With the rise of DTF transfers and other customization techniques, it’s easier than ever to transform basic apparel into eye-catching pieces. In this blog, we will explore innovative methods for customizing blank apparel, the benefits of using Ready-to-Press designs, and tips for achieving the best results.

Understanding DTF Transfers

DTF transfers (Direct-to-film transfers) are a cutting-edge printing technology that allows for detailed and vibrant designs to be applied to fabric using a heat press. Unlike traditional screen printing, DTF transfers offer greater flexibility and detail, making them ideal for intricate designs and multi-color prints. The process involves printing the design onto a special film, which is then transferred onto the fabric using heat and pressure.

Benefits of Teacher Transfers Designs

Teacher Transfers designs are pre-made transfers that are ready to be applied to garments. This convenience saves time and effort, allowing for quick customization without the need for extensive setup or equipment. Ready to Press designs are perfect for small businesses, hobbyists, and anyone looking to create custom apparel with minimal hassle.

Personalized T-Shirts for 4th July Independence Day

Create patriotic apparel for the 4th July Independence Day celebrations with custom DTF transfers. Design unique t-shirts featuring stars, stripes, and other patriotic symbols. Using Ready to Press transfers ensures a quick and easy application process, allowing you to produce festive apparel in no time.

Customized Hoodies with Unique DTF Designs

Transform plain hoodies into statement pieces with DTF designs. Whether it’s a cool graphic, a motivational quote, or a custom logo, DTF transfers can add a unique touch to your hoodies. Choose Black Apparel for a bold and Black stylish look that highlights the vibrant colors of the transfers.

Branded Merchandise for Small Businesses

Small businesses can benefit from custom Blank Apparel as part of their branding strategy. Use DTF heat transfers to add your business logo, tagline, or artwork to t-shirts, caps, and tote bags. This not only promotes brand recognition but also provides a professional and cohesive look.

Sports Team Apparel with DTF Prints

Customizing sports team apparel is another excellent use for DTF prints. Whether it’s jerseys, practice shirts, or fan gear, DTF transfers can create high-quality, durable designs that withstand the rigors of athletic activity. DTF prints for sale can also be offered as merchandise for fans.

Fashion Forward with Custom Tote Bags

Tote bags are a popular and practical accessory. Customize blank tote bags with DTF transfer prints featuring trendy designs, inspirational quotes, or personalized messages. These custom bags make great gifts, promotional items, or additions to your product line.

Seasonal Apparel for Holidays and Events

Create themed apparel for holidays and special events using DTF transfers ready to press. From Halloween costumes to Christmas sweaters, the possibilities are endless. Ready-to-Press transfers make it easy to produce seasonal apparel without investing in expensive equipment.

Where to Buy DTF Transfers

Finding high-quality DTF transfers is essential for achieving the best results. Look for reputable suppliers that offer a variety of designs and customization options. When searching for where to buy DTF transfers, consider factors such as print quality, durability, and ease of use.

Conclusion

Customizing blank apparel with DTF transfers offers endless possibilities for creativity and personalization. Whether you’re creating unique t-shirts for a holiday celebration, branded merchandise for your business, or stylish accessories, DTF transfers provide a versatile and efficient solution. Embrace the convenience of ready-to-press designs and explore the many ways you can transform blank apparel into stunning custom pieces.

FAQ

- What are DTF transfers?

- DTF transfers are a printing technology that applies detailed and vibrant designs to fabric using a heat press.

- How do I apply for DTF transfers?

- DTF transfers are applied using a heat press, which involves pressing the transfer onto the fabric at a specific temperature and pressure.

- What is Ready to Press?

- Ready to Press refers to pre-made transfers that are ready to be applied to garments with a heat press.

- What types of blank apparel are best for DTF transfers?

- High-quality, durable fabrics such as cotton, polyester, and blends are ideal for DTF transfers.

- Where can I buy DTF transfers?

- You can purchase DTF transfers from reputable suppliers that offer a variety of designs and customization options.

- Can I use DTF transfers on dark-colored apparel?

- Yes, DTF transfers work well on both light and dark-colored apparel, including Black Apparel.

- How long do DTF transfers last?

- DTF transfers are known for their durability and can last through many washes without fading or peeling.

- Are DTF transfers safe for all fabrics?

- DTF transfers are suitable for most fabrics, but checking the fabric’s heat tolerance before applying is essential.

- Can I create custom designs with DTF transfers?

- DTF transfers allow for intricate and custom designs, making them perfect for personalized apparel.

- How do I care for apparel with DTF transfers?

- Wash the apparel inside out in cold water and avoid using bleach or harsh detergents to maintain the transfer quality.

Sales & Marketing

How to Target and Optimize Your E-commerce Ads for Conversions

E-commerce is a cutthroat industry, which most businesses realize once they step into it. With many ditching brick-and-mortar stores for the convenience of online shopping, the competition has never been fiercer. It’s like there’s a never-ending quest to try to capture your audience’s attention!

However, having a stellar product doesn’t cut it anymore. You need to get it in front of the right eyes and convince them it’s worth buying. Marketing your business is the play here, as well as optimizing your e-commerce ads and campaigns.

Think about it: what good is the perfect ad if you show it to someone who will never buy what you’re selling? You want your campaigns to reach those who are not only interested but ready to convert. Continue reading to discover how to target and optimize your e-commerce ads to get the necessary conversions.

The Growing Saturation of E-commerce Advertising

E-commerce advertising is getting saturated, so getting your ads noticed by your target audience will be an uphill climb. 2023 global e-commerce sales hit around US $5.8 trillion, with experts predicting it to surpass US $8 trillion by 2027.

Seeing those numbers means a lot of potential to get a piece of the pie, but that also means a lot of noise to cut through. Users are constantly bombarded with left, right, and center ads, making capturing their attention challenging for any single ad.

Targeted advertising is the key to surviving—and thriving—in the saturated market. By homing in on your ideal customer base, you can make your ad spending more efficient and safeguard that your ads reach those most likely to convert.

Targeting Strategies for E-commerce Ads

To hit the mark with your e-commerce ads, you need to know your target. You need to perform some market research. Here’s a breakdown of the various audience targeting options offered by advertising platforms:

1. Demographics

This option includes age, location, income, gender, and more. Tailoring your ads based on these factors guarantees you’re speaking directly to those most likely interested in your product.

2. Interests

Dive into your audience’s shopping habits, browsing behavior, and preferred product categories. Platforms like Facebook and Google allow you to target users based on these interests, keeping your ads relevant.

3. Lookalike audiences

These are users who are like your existing customer base. You can expand your reach to new, highly relevant potential customers by targeting lookalikes.

4. Retargeting

Ever notice ads for a product you just viewed online following you around? That’s retargeting. It’s an effective way to re-engage users who have interacted with your brand before but haven’t yet converted.

5 Tips for Optimizing for Conversions: E-commerce Ad Best Practices

Now that you know who to target, here are some ways to make your ads irresistible:

1. Crafting compelling ad copy

The words you use in your ad must be clear, concise, and packed with benefits. Speak your audience’s language and highlight what makes your product a must-have.

2. Using high-quality visuals

A picture is worth a thousand words, and a video even more. Use eye-catching product images and captivating videos to grab attention and showcase your offerings with the best lighting and color grading.

3. Landing page optimization

Ensure that your landing page is related to your ad so you provide a seamless user experience. A clutter-free, easy-to-navigate landing page can significantly boost conversions.

4. A/B testing and refinement

Experiment with ad variations, including copy, visuals, and calls to action. A/B testing helps you recognize the most effective combinations for your audience, allowing you to refine your ads for better performance.

5. Conversion tracking and analytics

Tracking conversions and analyzing ad performance using analytics tools is crucial because it helps you understand what’s working and what’s not so you can keep optimizing your campaigns for better results.

Mastering the Art of E-commerce Ads

Your success in the e-commerce industry lies in getting the attention of your target audience by effectively targeting and optimizing your ads. By understanding your customers’ demographics and behaviors and using advanced targeting options, your ads will resonate with the right people.

Crafting compelling ad copy, using captivating visuals, and optimizing your website’s landing pages are all crucial steps to boost conversions. However, it doesn’t end there. The key to sustained success is the ongoing process of monitoring, testing, and refining your campaigns.

Sales & Marketing

Unveiling the Ultimate Winning Products List: A Comprehensive Guide to Dropshipping Success

In the dynamic realm of e-commerce and dropshipping, finding winning products that resonate with your target audience is the key to success. However, identifying these products amidst the vast sea of options can be a daunting task. To simplify this process and provide dropshippers with a competitive edge, Minea has curated the ultimate Winning Products List – a carefully selected collection of high-potential products that are primed for success in the ever-evolving world of e-commerce.

Unlocking the Potential of Minea’s Winning Products List: A Game-Changer for Dropshippers

Minea’s Winning Products List is more than just a compilation of products; it’s a strategic resource designed to empower drop shippers to make informed decisions and drive profitability in their businesses. With its curated selection and in-depth analysis, Minea’s Winning Products List offers dropshippers valuable insights and opportunities to stay ahead of the competition and achieve success in the fast-paced world of dropshipping.

Exploring Minea’s Winning Products List Key Features: Your Pathway to Dropshipping Success

Curated Selection: Discover High-Potential Products Market Analysis: Understand Market Trends and Demand Product Insights: Access Detailed Product Information Competitor Analysis: Gain Competitive Intelligence

Harnessing the Power of Curated Selection: Discover High-Potential Products

Finding winning products is the cornerstone of dropshipping success, and Minea’s Winning Products List streamlines this process by offering a carefully curated selection of products that have been vetted for their potential to perform well in the market. By leveraging Minea’s expertise and market insights, dropshippers can discover high-potential products with confidence and focus their efforts on products with the greatest likelihood of success.

Simplifying Market Analysis: Understand Market Trends and Demand

Staying abreast of market trends and consumer demand is essential for identifying winning products in the highly competitive dropshipping landscape. Minea’s Winning Products List provides dropshippers with valuable market analysis and trend data, allowing them to make data-driven decisions and capitalize on emerging opportunities. By understanding market dynamics and consumer preferences, dropshippers can align their product selection with market demand and maximize their chances of success.

Accessing Product Insights: Detailed Product Information at Your Fingertips

Detailed product information is crucial for evaluating the viability of potential winning products and making informed decisions. Minea’s Winning Products List offers dropshippers comprehensive product insights, including product descriptions, images, pricing information, and more. By accessing detailed product information, dropshippers can assess product potential, identify unique selling points, and make informed decisions about which products to add to their inventory.

Gaining Competitive Intelligence: Analyze Competitor Strategies

Understanding competitor strategies is key to gaining a competitive edge in the world of dropshipping. Minea’s Winning Products List allows dropshippers to analyze competitor products and strategies, providing valuable insights into market dynamics, pricing strategies, and marketing approaches. By studying competitor products, dropshippers can identify gaps in the market, differentiate their offerings, and develop strategies to outperform competitors.

Advanced Features for Enhanced Performance: Taking Your Dropshipping Business to the Next Level

Product Performance Metrics: Track Product Success Price Monitoring: Stay Competitive in the Market Inventory Management: Optimize Product Selection and Availability

FAQs: Answering Your Burning Questions About Minea’s Winning Products List

What criteria does Minea use to select products for the Winning Products List? How frequently is the Winning Products List updated? Can I request specific products to be added to the Winning Products List? Is the Winning Products List suitable for beginners in dropshipping? How can I integrate the Winning Products List into my existing dropshipping business?

Conclusion

As we conclude our exploration of Minea’s Winning Products List and its role as the ultimate resource for dropshipping success, we are reminded of the transformative power of curated selection, market analysis, and competitive intelligence in driving profitability and growth in the dropshipping industry. With its curated selection, comprehensive insights, and advanced features, Minea’s Winning Products List empowers dropshippers to discover high-potential products, understand market trends, and outperform competitors in the fast-paced world of dropshipping.

Whether you’re a seasoned dropshipper looking to expand your product portfolio or a newcomer seeking guidance in the world of dropshipping, Minea’s Winning Products List is here to support you every step of the way.

-

Sports & Games4 years ago

Sports & Games4 years agoLet’s Dive Into To Know about Poe Ninja

-

News & Entertainment2 years ago

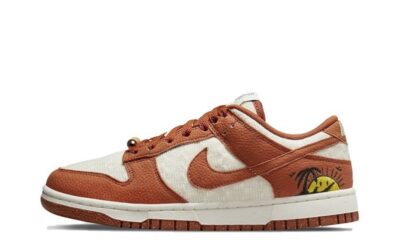

News & Entertainment2 years agoNike reps shoes

-

Business & Finance5 years ago

Business & Finance5 years agoLine Of Business

-

Sports & Games4 years ago

Sports & Games4 years agoIs a Toto site required for food verification?

-

Business & Finance4 years ago

Business & Finance4 years ago10 Best Online Platforms to Buy and Sell Cars in Karachi

-

Sports & Games4 years ago

Sports & Games4 years agoHow To Get Registered At Track Wrestling Forum

-

Sports & Games4 years ago

Sports & Games4 years agoHow will toto site help you find the best safe playground?

-

Sports & Games4 years ago

Sports & Games4 years agoHow Can You Easily Win Lottery Games?