Business & Finance

Ameer Zaki

He is an expert in real estate, a wealth development coach, an author, and a guest speaker. 18-year-old Zaki Ameer arrived in Australia with an unwavering determination to succeed in his business dreams and not only land on his feet.

With a lack of friends, no income, and a significant debt due to university fees, Zaki found himself living in an alien culture with few friends. As he decided to stay in Australia, he spent the next four years working eight-hour days and studying business and finance at night. Then he would come home in the late hours of the night to complete coursework.

Eventually, Zaki, once out of debt and with a Bachelor of Business under his belt, had a chance meeting that inspired him to dabble in property investment. Zaki was able to secure a successful portfolio of ten properties, worth over $3 million, a few years after that.

In addition to speaking at seminars and events on wealth creation and personal development, Zaki quickly became known for his incredible achievements. This was the place where he discovered his passion for sharing knowledge, and this led him to create DDP Property (DDP), a unique wealth creation program, in 2012.

DDP has helped close to 1,800 clients purchase more than 1,400 properties over the past several years. As part of its commitment to the community, DDP Property gives back to a variety of nonprofit organizations. Among the charities they have supported and continue to support are Children’s Hospital at Westmead, Sydney Young Professionals, Tiny Miracles, The Sri Lankan Annual Ball, and The Raise Foundation ifvod.

The purpose of Zaki’s business is to provide clients with information and guidance as they begin their own property investing journeys. The company, which Zaki started with just one employee, now has 15 employees who provide each DDP client with customised, ongoing service to meet all their changing circumstances and needs.

In his role as mentor, Zaki advises and mentors his team every day in relation to the business of the client, as well as in relation to their professional development. Many of his team members have created their own investment portfolios. One of Zaki’s team members grew his portfolio from 0 to 10 properties in just two years through personal mentoring.

DDP’s Kickstart program is another example of its unique and affordable services developed to give Gen Y’s the help they need to enter the property market while also establishing financial literacy.

To be recognized as one of the world’s most significant wealth creation, real estate investment companies, Zaki’s long-term vision for DDP is both to continue developing innovative strategies and services for clients and to achieve global recognition.

This blog was started by an Australian many years ago. Consumers can get the facts from an independent source. Do not sugarcoat the information or be negative. In spite of being an optimist, I am also able to smell BS easily.

My experience as an investor has shown that property investment returns are not very high. To increase my returns on investments, I am looking for better methods. And they were right there! My free training course has helped thousands of Australians. Let’s discuss it later.

gb whatsapp apk download gb whatsapp whatsapp apk apk download whatsapp download

gb whatsapp apk download latest version gb whatsapp whatsapp apk apk download download latest latest version latest gb version

Download Youtube Video Download Youtube Youtube Video Download Video

AMAZONE innovations throughout the world AMAZONE innovations innovations throughout throughout the world AMAZONE world

Tn machi Da Has Blocked In India Tn machi Da Has Blocked In India Tn machi Blocked Blocked In India

Business & Finance

How to Use Online Loans to Finance Your Dream Home in the Philippines

Owning a home is a dream for many Filipinos. It represents stability, security, and a solid investment for the future. However, the reality is that purchasing a property often requires a significant amount of money, which can be a daunting challenge. This is where loans online come into play, offering a convenient and accessible solution to help turn your dream of homeownership into a reality.

Understanding Online Loans for Home Financing

Online loans, also known as personal loans or cash loans, are a type of financing that allows you to borrow a lump sum of money from a lender. These loans are typically unsecured, meaning you don’t need to provide any collateral, such as a house or a car. Instead, lenders like Cash Express assess your creditworthiness based on factors like your income, employment status, and credit history.

One of the significant advantages of online loans is their convenience. You can apply for a loan from the comfort of your own home, without the need for lengthy paperwork or multiple branch visits. Online lenders leverage technology to streamline the application process, making it faster and more efficient.

Benefits of Using Online Loans for Home Financing

- Quick Access to Funds: The approval process for online loans is generally quicker than traditional bank loans. This means you can access the funds you need for your home purchase more rapidly, allowing you to act quickly in a competitive real estate market.

- Flexible Repayment Terms: Online lenders often offer flexible repayment terms, allowing you to choose a schedule that fits your budget and financial situation. This can make it easier to manage your monthly expenses while paying off your loan.

- No Collateral Required: Since online loans are typically unsecured, you don’t need to put up any collateral, such as your home or car. This can be especially beneficial if you’re a first-time homebuyer or have limited assets.

- Competitive Interest Rates: Many online lenders offer low interest rates, which can help you save money eventually compared to other financing options.

How to Use Online Loans for Home Financing

- Determine Your Financing Needs: Start by calculating the total cost of your dream home, including the purchase price, closing costs, and any necessary renovations or repairs. This will help you determine the amount you need to borrow.

- Check Your Credit Score: Lenders will review your credit score to assess your creditworthiness. Check your credit report and address any errors or issues that could negatively impact your score.

- Shop Around for Lenders: Research different online lenders and compare their interest rates, fees, and repayment terms. Look for lenders with positive reviews and a reputation for transparency and excellent customer service.

- Apply for the Loan: Once you’ve chosen a lender, complete the online application process. Be prepared to provide information about your income, employment, and any outstanding debts.

- Use the Loan for Your Home Purchase: Upon approval and disbursement of the loan, use the funds to finance your dream home purchase. You can use the loan to cover the down payment, closing costs, or any other expenses related to the transaction.

- Manage Your Repayments: Develop a budget and stick to your repayment schedule to avoid late fees and potential credit score damage. Consider setting up automatic payments to ensure you never miss a payment.

Tips for Successfully Using Online Loans for Home Financing

- Improve Your Credit Score: A higher credit score can qualify you for better interest rates and loan terms. Pay your bills on time, reduce your debt-to-income ratio, and avoid opening new credit accounts before applying for a loan.

- Consider a Co-Borrower: If your income or credit score is not strong enough, consider applying for the loan with a co-borrower, such as a family member or a spouse, to increase your chances of approval and potentially qualify for better terms.

- Explore Additional Financing Options: Online loans can be a great solution, but you may also want to explore other financing options, such as government-backed loans or traditional mortgage loans, to find the best fit for your situation.

- Understand the Terms and Conditions: Before signing any loan agreement, carefully read and understand the terms and conditions, including interest rates, fees, and repayment schedules. Don’t hesitate to ask questions or seek clarification from the lender.

Owning a home is a significant investment, and online loans can provide the financial support you need to make your dream a reality. By following these tips and working with a reputable online lender like Cash Express, you can navigate the home financing process with confidence and achieve the goal of homeownership in the Philippines.

Business & Finance

Dubai’s One Za’abeel F&B Scene Unveiled

Photographed with the adept eyes of Alex Jeffries, The Hotels restaurants, have been unveiled and launched to the world, including Street XO, La Dame De Pic, DuangDy, Qabu and Andaliman.

Discover the Link

A futuristic boulevard floating above the city, The Link is home to four signature restaurants from Michelin-lauded chefs, elevated all-day dining, and Arrazuna, a reimagined gourmet food hall.

Design Team

The link is now officially recognised as the world’s Longest Cantilevered Building. One Za’abeel has been awarded a total of four Guinness World Records now, including the one for the iconic 230-meter long cantilevered skybridge – The Link that joins the two towers of the scheme and spans over a major four-lane highway. Both reputable design companies LW and Social F+B have been involved with the design

Location

No stranger to Hospitality and restaurants and bars photography Alex Jeffries Photography Group were thrilled to be asked to photograph the new F&B venues in the Link, located in the well-known uber new luxury hotel, the One & Only, Za’abeel One, Dubai.

Capturing Architectural Harmony – Interior Design Excellence

Interior photography by Alex Jeffries, a firm favourite, was chosen by many of the leading Architecture, Lighting, and Interior Design companies in Dubai to help them build a portfolio and win awards in local and global competitions.

About Alex

Alex Jeffries is a British Photographer, working and photographing around the region for over fifteen years, qualified with the British Institute of Professional Photography, the Federation of European Professional Photographers and the British Master Photographers Association.

Specialty

Alex specialises in Interior Photography, Architecture and Hotels and Hospitality. Regularly shooting for many of the global brand Hotels that have a footprint in the region, Alex specialises in shooting at the pre-opening stage, in helping launch a new hotel to the market.

What can Alex do for you?

Interior photography by Alex Jeffries – What can Alex do for you? He specialises in helping Interior and Architecture clients build their portfolios and win awards. And with his proven solid experience in the region helping launch to market many of the local and global Hotel brands that demand and expect the highest standards his professional experience ensures you will get the return on investment you need.

Business & Finance

Unlocking the Power of Customer Reviews for Your Business

Welcome to our guide on how to get reviews for your business! In today’s digital age, customer reviews play a crucial role in shaping the reputation and success of businesses. In this article, we’ll explore the importance of customer reviews, effective strategies for obtaining them, and common questions businesses have about soliciting feedback from customers.

Understanding the Impact of Reviews

Customer reviews provide valuable insights into the quality of products or services offered by a business. They serve as social proof, helping potential customers make informed purchasing decisions. Positive reviews can enhance credibility, attract new customers, and improve search engine rankings, while negative reviews can damage reputation and deter potential customers.

Key Strategies for Obtaining Reviews

- Provide Excellent Customer Experience: Offer exceptional products and services to ensure customer satisfaction and increase the likelihood of receiving positive reviews.

- Ask for Reviews: Actively encourage satisfied customers to leave reviews by including a call-to-action on receipts, invoices, or follow-up emails.

- Utilize Review Platforms: Create profiles on popular review platforms such as Google My Business, Yelp, Facebook, and industry-specific sites where customers can easily leave reviews.

- Offer Incentives: Offer incentives such as discounts, coupons, or loyalty points in exchange for leaving a review, but ensure compliance with platform guidelines.

- Make It Easy: Simplify the review process by providing direct links or instructions on how to leave a review on various platforms.

Steps to Obtain Reviews for Your Business

- Identify Review Channels: Determine which review platforms are most relevant to your business and where your target audience is likely to search for reviews.

- Develop a Review Request Process: Create a standardized process for requesting reviews from customers, including when and how to ask for feedback.

- Train Your Staff: Train your employees on the importance of reviews and how to ask customers for feedback in a polite and non-intrusive manner.

- Monitor and Respond: Regularly monitor review platforms for new reviews and respond promptly, whether they are positive or negative, to show that you value customer feedback.

- Track Performance: Track the number of reviews received, sentiment, and any changes in customer behavior or sales attributable to reviews.

FAQs (Frequently Asked Questions)

- Can I ask customers to leave reviews? Yes, it’s acceptable to ask satisfied customers to leave reviews, but be sure to do so in a respectful and non-coercive manner.

- Is it ethical to offer incentives for reviews? Offering incentives for reviews is acceptable as long as it complies with platform guidelines and doesn’t influence the content of the review.

Conclusion

In conclusion, obtaining reviews for your business is essential for building trust, credibility, and reputation among customers. By implementing effective strategies and soliciting feedback from satisfied customers, businesses can harness the power of reviews to attract new customers, retain existing ones, and drive long-term success.

-

Sports & Games3 years ago

Sports & Games3 years agoLet’s Dive Into To Know about Poe Ninja

-

News & Entertainment1 year ago

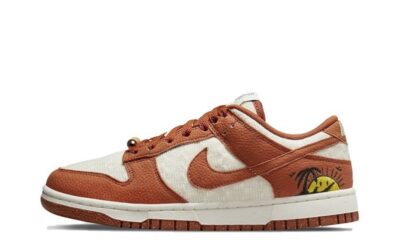

News & Entertainment1 year agoNike reps shoes

-

Sports & Games3 years ago

Sports & Games3 years agoIs a Toto site required for food verification?

-

Business & Finance3 years ago

Business & Finance3 years ago10 Best Online Platforms to Buy and Sell Cars in Karachi

-

Sports & Games3 years ago

Sports & Games3 years agoHow To Get Registered At Track Wrestling Forum

-

Sales & Marketing3 years ago

Sales & Marketing3 years agoWhat is Amaozn And How It Works?

-

Categorize1 year ago

Categorize1 year agoCommon Mistakes When Making A Medical Case Study

-

Technology & Inovation3 years ago

Technology & Inovation3 years agoTop 5 WEBSITE RESELLER