Business & Finance

MyChargeBack Client Recovers $300,000 Plus Damages from Crypto Fraud

The stories of people who have been exploited by trading scams may have similar patterns, but each one is unique. At MyChargeBack, we see numerous success stories, but the restoration of funds for a New Zealand couple demonstrates that patience and persistence pay off if the MyChargeBack has your back.

A New Zealand couple we’ll refer to as the Beasleys (not their real name) are retirees who simply wanted to make enough money to purchase a home for their son. Sadly, they were led right into a crypto trading scam that laundered their money and transformed the process of tracking their funds into a Herculean effort.

Cryptocurrency has had its ups and downs since its inception, and one of its major peaks was in 2017 when the price of bitcoin rose from $1,100 to nearly $20,000. At the time, the prevailing view was that the bitcoin price would keep going up and that people were making millions from speculating on altcoins.

More…and Less….Than They Bargained For

The Beasleys felt certain that crypto investing was the answer to creating financial stability for their children and grandchildren. Unfortunately, as retirees, this involved a sacrifice that would harm their own finances, and they faced years of lost returns in money that otherwise could have been invested by a legitimate broker.

There were red flags from the beginning, but the friendly manner of “George” and “Wes” (not their real names) had them fooled, at least for a while. Although both of them claimed to live in London, they didn’t have English accents.

This isn’t the biggest red flag–maybe they were born somewhere else, but when Mrs. Beasely tried to make small talk with them about Prince William’s wedding, they seemed absolutely oblivious and confused.

An English national not knowing about a royal wedding is odd, but not a crime. Still it raised eyebrows. Nevertheless, any questions about the identity of George and Wes faded away with their friendly manner and promises of huge returns.

Red Flags Start to Emerge

However, there were more surprises in store for the Beasleys. Although they intended to trade cryptocurrency, George and Wes said that they were instead opening a “trading account” for the Beasleys and their money would be invested in stocks, not cryptocurrencies.

This should have given the couple reason to be suspicious – after all, they wanted to trade specifically cryptocurrencies and were told they would be investing in stocks. George and Wes glossed over this without a comment, which is an indication of their attitude towards their customers.

However, George and Wes buttered up the Beasleys by sending Mrs. Beasley a bouquet of flowers when she came home after a medical procedure. This seems thoughtful, but it was actually a bribe.

When it was time to fund the account, the Beasleys were told that they needed to trade at least a six-digit figure for the best outcome. George and Wes demanded three payments, one to a bank account in Hong Kong, one to Hungary, and one to Slovakia. This is a huge red flag, but by that time, the Beasleys believed these brokers were legitimate.

The first transfer was made to Hong Kong. The bank in Hungary, however, froze the funds as soon as the transfer was made. The Beasley’s bank refused to make the transfer to Slovakia because at that point, it was clear George and Wes were involved in a suspicious business.

MyChargeBack Has the Solution

The Beasleys discovered their money was in the hands of crypto fraudsters. They went to the local police and got Interpol involved but there was no progress in finding out more about George and Wes’ operation or getting Beasley’s funds back.

Fortunately, the Beasleys found MyChargeBack on the internet. Our experts got to work immediately investigating George and Wes’ sham operation. It emerged that George and Wes weren’t merely lacking in crypto trading – they didn’t offer any brokerage services at all.

MyChargeBack experts proved that George and Wes were unlicensed and all funds went right into accounts in various countries. They then further laundered this money to legitimate-seeming services.

With MyChargeBack’s thorough investigation report, the regulator was able to order the bank to unfreeze Beasley’s funds and to track down the money that was stolen by George and Wes. Finally, the Beasleys received £200,000, which included their principal as well as extra money in compensation.

MyChargeBack Will Investigate Your Crypto Case

If you have lost money on the blockchain through unregulated brokers, bitcoin wallet hacking or fake merchants, talk to the MyChargeBack team. Our crypto investigations will provide evidence to bolster your claim.

MyChargeBack has developed working relationships with law enforcement agencies worldwide, have extensive knowledge and experience with crypto tracking and can improve your prospects of getting your funds back.

Business & Finance

Home Buying Dos and Don’ts You Need to Know

Buying a home is a process filled with enthusiasm, anticipation, and a fair share of stress. Whether you are a first-time homebuyer or a seasoned property owner, navigating the real estate market can be daunting. Making informed decisions is vital to ensure your home purchase is a sound investment and a positive experience.

This guide aims to provide you with essential dos and don’ts to help you successfully traverse the complexities of buying a home. With careful preparation and consideration, you can turn the dream of homeownership into a rewarding reality.

7 Dos And Don’ts You Need To Know Before Buying Your First Home

From initial research to closing the deal and moving in, let’s look at practical advice for each step.

Dos

1. Do Your Research

Before diving into the home-buying process, invest some time in researching the real estate market. Understand property values, the latest market trends, and economic factors that might influence your purchase. Research neighborhoods thoroughly, considering factors like schools, facilities, crime rates, and upcoming development plans to ensure they align with your lifestyle and needs.

2. Get Pre-Approved for a Mortgage

Obtaining a mortgage pre-approval early in the process clarifies your budget. It also demonstrates to sellers that you’re a serious buyer. This crucial step not only helps you understand your borrowing capacity but also gives you a competitive edge in a hot market where multiple offers are common.

3. Work with a Real Estate Agent

A skilled and knowledgeable real estate agent can guide you through the complexities of buying a home. They have access to exclusive listings, can negotiate the best price, and provide invaluable advice. Opt for an agent with a solid track record and experience in the area you’re interested in to ensure a smooth process.

4. Set a Realistic Budget

Establishing a realistic budget is important for a successful home purchase. Factor in all related costs, including mortgage payments, property taxes, insurance, and maintenance. Avoid stretching your finances too thin by sticking to a budget that ensures long-term financial stability and prevents potential stress.

5. Inspect the Property

Always hire an expert home inspector to thoroughly evaluate the property before finalizing your purchase. An inspection can reveal hidden issues, such as structural problems or faulty systems, that may not be visible during a casual walkthrough.

6. Consider Future Resale Value

While buying your dream home, it’s crucial to consider its future resale value. Look at factors like location, neighborhood growth, and property condition. For example, if you live in Pakistan, look for projects by the top builders in Karachi, as they will have all the amenities that define a good home and will likely appreciate over time. The key to success is to think long-term and ensure your investment remains attractive to future buyers, enhancing your financial stability and flexibility.

7. Read and Understand the Contract

- Real estate contracts are complex documents filled with legal terms. Before signing, read and comprehend all the terms and conditions. If any part is unclear, consult your real estate agent or attorney for clarification. Understanding your contract ensures you know exactly what you are agreeing to and protects you from unexpected obligations or liabilities.

Don’ts:

1. Don’t Rush the Process

Buying a home is a significant investment, and it’s crucial to take your time. Rushing can lead to costly mistakes, overlooked details, and buyer’s remorse. Thoroughly evaluate your options, visit multiple properties, and ensure your selected home meets your long-term needs and budget constraints.

2. Don’t Overlook Additional Costs

Beyond the initial price, homeownership comes with numerous additional expenses. These include closing costs, property taxes, home insurance, maintenance, and unexpected repairs. Factor in these costs when budgeting to avoid financial strain and ensure you can conveniently afford your new home.

3. Don’t Ignore the Neighborhood

The neighborhood is as significant as the property you invest in. Investigate the area’s safety, schools, amenities, and future development plans. Visit at different times to gauge noise levels and traffic. A great house in a problematic neighborhood can affect your quality of life and the home’s future resale value.

4. Don’t Make Large Purchases Before Closing

Avoid significant financial changes before closing, such as buying a car or opening new credit lines. These actions can alter your credit score and debt-to-income ratio, potentially jeopardizing your mortgage approval. Lenders recheck your finances before finalizing the loan, so maintain financial stability until closing.

5. Don’t Skip the Final Walkthrough

A final walkthrough is essential to confirm the property’s condition before closing. Ensure agreed-upon repairs are complete, and check for new issues. This step helps avoid unpleasant surprises, ensuring that you are aware of any problems and can address them before finalizing the purchase.

6. Don’t Neglect Future Planning

Consider your long-term plans when purchasing a home. Think about family growth, career changes, and lifestyle needs. Choose a home that can adapt to future changes, ensuring it remains suitable and convenient as your circumstances evolve, thereby avoiding the need for another move too soon.

7. Don’t Forget to Negotiate

Negotiation is a critical aspect of home buying. Don’t accept the initial offer without attempting to negotiate the price, closing costs, or requested repairs. Skilled negotiation can save you money and secure better terms, making the purchase more financially favorable and suited to your needs.

Wrapping Up

Navigating the home-buying process can be challenging. However, if you are armed with the right information and have a clear strategy, it can also be one of the most rewarding experiences of your life. By following the dos and don’ts defined above, you can avoid the challenges and make informed decisions that will benefit you in the long run.

Remember to be patient, do thorough research, and leverage the expertise of professionals like real estate agents and mortgage advisors. Whether you’re a first-time homebuyer or a seasoned property owner, a thoughtful and methodical approach will help ensure that you find a home that not only meets your current needs but also serves as a sound investment for the future. Happy house hunting!

Business & Finance

Unlock Financial Freedom with Cash-Express: Your Go-To Online Lender

In today’s fast-paced world, unexpected expenses can strike at any moment, leaving you scrambling for a quick financial solution. Whether it’s a medical emergency, a car repair, or an opportunity you can’t afford to miss, finding a reliable and trustworthy online lender has never been more crucial. Enter Cash-Express – your ultimate destination for hassle-free legit online loans that empower you to take control of your financial situation.

Why Choose Cash-Express?

When it comes to online lending platforms, not all are created equal. Cash-Express stands out from the crowd, offering a seamless and transparent experience that puts your needs first. Here are the top reasons why you should choose this legit online platform for your next loan:

- Convenience at Your Fingertips: Say goodbye to the hassle of visiting physical lenders or navigating through endless paperwork. With Cash-Express, you can apply for a loan from the comfort of your home or on-the-go, thanks to their user-friendly online platform. No more wasting precious time in queues or juggling schedules – convenience is the name of the game.

- Lightning-Fast Approval Process: Time is money, and Cash-Express understands that. Their streamlined approval process ensures that you receive a decision on your loan application in record time. No more waiting for days or weeks to get the financial assistance you need – with Cash-Express, you can have the funds you require in your account faster than you can say “online loan.”

- Flexible Loan Options: Whether you need a small sum to tide you over until your next payday or a larger amount to tackle a more significant expense, Cash-Express has you covered. Their diverse range of loan options caters to various financial needs, ensuring that you can find a solution tailored to your unique circumstances.

- Competitive Interest Rates: Let’s face it – no one wants to pay exorbitant interest rates that eat into their hard-earned money. Cash-Express prides itself on offering competitive interest rates that won’t break the bank. Say goodbye to predatory lenders and hello to fair and transparent pricing that works in your favor.

- Excellent Customer Support: When it comes to managing your finances, having a reliable support system can make all the difference. Cash-Express boasts a dedicated team of knowledgeable and friendly customer service representatives who are always ready to assist you with any queries or concerns you may have. Their commitment to exceptional customer service ensures that your online lending experience is smooth and stress-free.

- Secure and Trustworthy Platform: In the digital age, privacy and security are paramount. Cash-Express understands this and has implemented robust security measures to safeguard your personal and financial information. With state-of-the-art encryption and strict data protection protocols, you can rest assured that your sensitive data is in safe hands.

Unleash Your Financial Potential with Cash-Express

Whether you’re facing an unexpected expense, seizing an exciting opportunity, or simply need a little breathing room until your next payday, Cash-Express is your trusted ally. With their commitment to convenience, speed, flexibility, affordability, and exceptional customer service, you can rest easy knowing that your financial needs are in capable hands.

So, why wait? Visit Cash-Express today and take the first step towards financial freedom. Unlock a world of possibilities and embrace the power of online lending with a legit platform that truly puts your interests first.

FAQs

Q: How do I apply for a loan on Cash-Express?

A: Applying for a loan on Cash-Express is a simple and straightforward process. Just visit their website, fill out the online application form with your personal and financial details, and submit your request. Their team will promptly review your application and get back to you with a decision.

Q: What documents do I need to provide for a loan application?

A: The required documents may vary depending on your specific loan type and amount, but typically, you’ll need to provide Passport, National ID, Driver’s licence, SSS, UMID, Postal ID, PRC ID. (Note that we need you to provide the picture of at least 1 of the 7 Mandatory IDs and selfie holding the same ID).

Q: How long does it take to receive the loan funds?

A: Once your loan application is approved, Cash-Express works diligently to transfer the funds to your designated bank account as quickly as possible. In most cases, you can expect to receive the loan amount from 15 minutes to 1 business day, allowing you to address your financial needs promptly.

Q: Can I repay my loan early without any penalties?

A: Absolutely! Cash-Express understands that financial situations can change, and they encourage their customers to repay their loans early if possible. They do not charge any prepayment penalties, so you can clear your debt ahead of schedule without incurring additional fees.

Q: Is Cash-Express a legitimate and trustworthy online lender?

A: Yes, Cash-Express is a fully licensed and regulated online lending platform that adheres to strict industry standards and best practices. They prioritize transparency, security, and customer satisfaction, ensuring that you can trust their services and feel confident in your decision to work with them.

Business & Finance

Introducing Cash-Express: The Fast and Easy Way to Get a Loan Online

Are you in need of a quick and convenient way to get a loan online in the Philippines? Look no further than Cash-Express, the leading online lending platform that makes borrowing a breeze. With our user-friendly interface and streamlined application process, you can get the funds you need quickly. Let’s dive into what makes Cash-Express the go-to choice for online lending in the Philippines.

Why Choose Cash-Express?

Fast and Easy Application Process

At Cash-Express, we understand that time is of the essence when you need a loan. That’s why we’ve made our application process as quick and easy as possible. Fill out our online form with your personal and financial information, and we’ll get back to you with a loan offer quickly. No need to visit a physical branch or wait in long lines – you can apply for a loan from the comfort of your own home.

Flexible Loan Options

We offer a range of loan options to suit your needs and budget. Whether you need a small personal loan to cover unexpected expenses or a larger loan for a major purchase, we’ve got you covered. Our loans are flexible and customizable, so you can choose the repayment terms that work best for you.

Competitive Interest Rates

We pride ourselves on offering competitive interest rates that are among the lowest in the industry. We believe that borrowing money should be affordable and accessible, which is why we work hard to keep our rates low. With Cash-Express, you can get the funds you need without breaking the bank.

Secure and Reliable

We take the security of your personal and financial information very seriously. Their platform is fully encrypted and uses the latest technology to protect your data from unauthorized access. You can trust that your information is safe with us. Plus, we have a team of experienced professionals who are dedicated to providing reliable and trustworthy lending services.

How to Apply for a Loan with Cash-Express

Applying for a loan with Cash-Express is straightforward. Here’s what you need to do:

- Visit our website at Cash-express and click on the “Apply Now” button.

- Fill out our online application form with your personal and financial information. This should only take a few minutes.

- Wait for our team to review your application. We’ll get back to you with a loan offer as soon as possible.

- If you accept our loan offer, we’ll transfer the funds directly to your bank account. It’s that easy!

FAQs

What types of loans does Cash-Express offer?

We offer a range of loan options, including personal loans, business loans, and payday loans. Our loans are flexible and customizable, so you can choose the repayment terms that work best for you.

How long does it take to get a loan from Cash-Express?

Our application process is quick and easy, and you can get a loan offer in as little as a few minutes. Once you accept our loan offer, we’ll transfer the funds directly to your bank account within 24 hours.

What are the requirements for applying for a loan with Cash-Express?

To apply for a loan with us, you need to be a Filipino citizen or resident, at least 21 years old, and have a stable source of income. You’ll also need to provide some personal and financial information as part of the application process.

How do I repay my loan with Cash-Express?

We offer flexible repayment options, including automatic deductions from your bank account or payment through other channels. You can choose the repayment method that works best for you.

-

Sports & Games4 years ago

Sports & Games4 years agoLet’s Dive Into To Know about Poe Ninja

-

News & Entertainment2 years ago

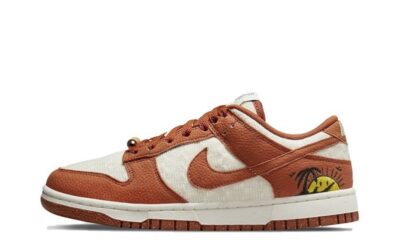

News & Entertainment2 years agoNike reps shoes

-

Business & Finance5 years ago

Business & Finance5 years agoLine Of Business

-

Sports & Games4 years ago

Sports & Games4 years agoIs a Toto site required for food verification?

-

Business & Finance4 years ago

Business & Finance4 years ago10 Best Online Platforms to Buy and Sell Cars in Karachi

-

Sports & Games4 years ago

Sports & Games4 years agoHow To Get Registered At Track Wrestling Forum

-

Sports & Games4 years ago

Sports & Games4 years agoHow will toto site help you find the best safe playground?

-

Sports & Games4 years ago

Sports & Games4 years agoHow Can You Easily Win Lottery Games?