Business & Finance

Essential Thing About Freight Forwarding

Freight forwarding is one of the most popular means of international transportation. It applies not only to businesses but also to people. Freight forwarding companies are in charge of managing the movement of products between two locations. Each cargo is completed by various carriers, ranging from air freight to ocean freight and, in some cases, train freight!

It may appear a complicated process, but the information provided here will teach you everything you need about freight forwarding for international shipments.

What Is a Freight Forwarder?

Freight forwarders are companies in charge of shipping products between two locations. The entire procedure is carefully planned and can include everything from warehousing to overseas delivery. They act as an advisor between shippers and transportation providers, negotiating the optimal route for all parties.

There Are Six Steps

Freight forwarding is a complex operation, but it can be divided into six steps to make it more manageable and understandable.

- Export haulage is the movement of products from the source to the freight forwarder.

- Customs Clearance (Export) – required for international shipping, products are cleared to depart the country.

- Validation and Handling – Following clearance, products are inspected and validated against the documents submitted.

- Customs Clearance (Import) – When everything arrives at the right spot, officials review the paperwork for the right products.

- Destination Handling – items are handled at their final destination, which includes the movement of commodities to the warehouse.

- Import Haulage – the items are moved to the final destination at the opposite end of the journey.

A Hassle-Free Option

Freight forwarders seek to reduce the costs associated with international export and import. They have experience in all aspects of the supply chain, from packing to managing customs from country to country.

Excellent for Business

If you are moving items to consumers on a large scale, then the right freight forwarder is all you need and will significantly help your business. Their knowledge and expertise will ensure that your items arrive on time every time while also saving you money.

Uncontrollable shipping delays

Freight forwarders can’t prevent errors or delays in overseas shipping. Sometimes they can’t fix problems. Bad weather, breakdowns, port delays, and last-minute modifications can happen.

You’re Responsible For The Paperwork

While your freight forwarder will manage practically all aspects of the overseas shipping process, you will be responsible for paperwork completion. This is critical if you do not want service interruptions!

There Are Product Restrictions

International shipping is strict when it comes to banned commodities you cannot send. There are strict rules to follow, including the prohibition of:

- Toxic and flammable liquids

- Drugs

- Batteries

- Perishable goods

- Alcohol

You Can Ask for Extras

Some freight forwarders provide additional services such as warehouse storage, cargo tracking, insurance, dangerous goods handling, etc. The best thing to do is to ask!

Business & Finance

From Indices to Oil: Exploring the Reach of CFDs

In the fast-paced world of financial trading, contracts for difference, or CFDs, have emerged as a flexible tool for investors seeking exposure to a variety of markets without the complexities of owning the underlying asset.

From the performance of global indices to the price movements of oil, CFDs allow traders to speculate on market trends with a level of agility that traditional investment vehicles may struggle to match. Understanding the scope and mechanics of CFDs is essential for both novice and experienced traders who wish to navigate these dynamic markets effectively.

Understanding CFDs and Their Versatility

At its core, a CFD is a derivative instrument that enables traders to speculate on the price movement of an asset without taking ownership of it. This could include equities, commodities, indices, or currencies. When a trader opens a CFD position, they agree with a broker to exchange the difference in the asset’s value between the opening and closing of the contract. If the asset’s price moves in the predicted direction, the trader profits; if it moves against them, they incur a loss.

One of the most compelling aspects of CFDs is their versatility. Traders can access a broad range of markets from a single platform, shifting seamlessly from equity indices to commodities such as oil or gold. This flexibility is particularly valuable in today’s interconnected financial landscape, where market movements are often influenced by global events rather than local factors alone.

The Appeal of Trading Indices with CFDs

Indices, which aggregate the performance of multiple stocks, provide a snapshot of market sentiment and sector performance. CFDs allow traders to speculate on these indices without purchasing individual shares, which can be more capital-intensive. For example, a trader may use CFDs to gain exposure to major benchmarks like the S&P 500, FTSE 100, or DAX. This approach allows for diversified market exposure and the opportunity to profit from both upward and downward movements, as CFDs enable short-selling just as easily as buying.

Another advantage of trading indices via CFDs is the ability to apply leverage. Leverage allows traders to control a larger position with a smaller amount of capital, potentially amplifying gains. However, it is important to note that leverage also magnifies losses, making effective risk management a critical component of any trading strategy.

Exploring Commodity Markets: Oil as a Case Study

Commodities, particularly oil, have long been at the centre of global economic dynamics. Oil prices are influenced by a complex interplay of factors, including geopolitical events, supply and demand fluctuations, and macroeconomic indicators. CFDs provide an accessible way for traders to engage with this volatility without the logistical challenges of physical trading or futures contracts.

Trading oil CFDs allows market participants to respond swiftly to price movements and take advantage of short-term opportunities. For instance, a sudden geopolitical event that disrupts supply can create a rapid shift in oil prices. A trader using CFDs can open a position to capitalise on this movement almost immediately, reflecting the high responsiveness that CFDs offer compared to traditional methods of commodity investment.

The Role of Technology and Brokerage Platforms

The accessibility and effectiveness of CFD trading are greatly enhanced by modern brokerage platforms. Advanced trading platforms provide real-time market data, analytical tools, and execution capabilities that allow traders to act on opportunities efficiently. Some brokers also offer educational resources, market insights, and demo accounts that enable traders to practice strategies in a risk-free environment.

For those looking to engage with a reliable brokerage in the Middle East, platforms such as ADSS UAE provide a gateway to a broad spectrum of CFD markets. By offering access to indices, commodities like oil, and other instruments, ADSS UAE combines regulatory compliance, technological robustness, and educational support to help traders make informed decisions. This integration of resources is particularly valuable for traders seeking to navigate complex global markets with confidence.

Embracing the Opportunities of CFDs

The appeal of CFDs lies in their adaptability, accessibility, and potential for strategic trading across diverse markets. From indices that reflect the pulse of global economies to commodities like oil that respond to shifting geopolitical landscapes, CFDs enable traders to engage with market movements in a way that is both dynamic and efficient.

However, the profit potential is accompanied by significant responsibility. A disciplined approach to risk management, combined with continuous learning and market analysis, is essential for success. By leveraging technology, reliable brokerage platforms, and a structured strategy, traders can potentially maximise the opportunities that CFDs present while mitigating the inherent risks.

Conclusion

CFDs represent a powerful tool for navigating today’s complex financial markets. They offer the flexibility to trade a wide array of assets, from global indices to volatile commodities like oil, without the constraints of traditional ownership. By understanding the mechanics of CFDs, employing robust risk management strategies, and utilising advanced trading platforms, traders can approach these markets with confidence and sophistication.

As financial markets continue to evolve, the ability to respond quickly and strategically will remain a key determinant of success. CFDs, with their broad reach and adaptability, provide a platform for traders to engage with the global economy in an informed and empowered way. Whether one is seeking to diversify a portfolio, hedge existing positions, or capitalise on short-term price movements, CFDs offer the tools and opportunities to do so effectively.

Business & Finance

Home Buying Dos and Don’ts You Need to Know

Buying a home is a process filled with enthusiasm, anticipation, and a fair share of stress. Whether you are a first-time homebuyer or a seasoned property owner, navigating the real estate market can be daunting. Making informed decisions is vital to ensure your home purchase is a sound investment and a positive experience.

This guide aims to provide you with essential dos and don’ts to help you successfully traverse the complexities of buying a home. With careful preparation and consideration, you can turn the dream of homeownership into a rewarding reality.

7 Dos And Don’ts You Need To Know Before Buying Your First Home

From initial research to closing the deal and moving in, let’s look at practical advice for each step.

Dos

1. Do Your Research

Before diving into the home-buying process, invest some time in researching the real estate market. Understand property values, the latest market trends, and economic factors that might influence your purchase. Research neighborhoods thoroughly, considering factors like schools, facilities, crime rates, and upcoming development plans to ensure they align with your lifestyle and needs.

2. Get Pre-Approved for a Mortgage

Obtaining a mortgage pre-approval early in the process clarifies your budget. It also demonstrates to sellers that you’re a serious buyer. This crucial step not only helps you understand your borrowing capacity but also gives you a competitive edge in a hot market where multiple offers are common.

3. Work with a Real Estate Agent

A skilled and knowledgeable real estate agent can guide you through the complexities of buying a home. They have access to exclusive listings, can negotiate the best price, and provide invaluable advice. Opt for an agent with a solid track record and experience in the area you’re interested in to ensure a smooth process.

4. Set a Realistic Budget

Establishing a realistic budget is important for a successful home purchase. Factor in all related costs, including mortgage payments, property taxes, insurance, and maintenance. Avoid stretching your finances too thin by sticking to a budget that ensures long-term financial stability and prevents potential stress.

5. Inspect the Property

Always hire an expert home inspector to thoroughly evaluate the property before finalizing your purchase. An inspection can reveal hidden issues, such as structural problems or faulty systems, that may not be visible during a casual walkthrough.

6. Consider Future Resale Value

While buying your dream home, it’s crucial to consider its future resale value. Look at factors like location, neighborhood growth, and property condition. For example, if you live in Pakistan, look for projects by the top builders in Karachi, as they will have all the amenities that define a good home and will likely appreciate over time. The key to success is to think long-term and ensure your investment remains attractive to future buyers, enhancing your financial stability and flexibility.

7. Read and Understand the Contract

- Real estate contracts are complex documents filled with legal terms. Before signing, read and comprehend all the terms and conditions. If any part is unclear, consult your real estate agent or attorney for clarification. Understanding your contract ensures you know exactly what you are agreeing to and protects you from unexpected obligations or liabilities.

Don’ts:

1. Don’t Rush the Process

Buying a home is a significant investment, and it’s crucial to take your time. Rushing can lead to costly mistakes, overlooked details, and buyer’s remorse. Thoroughly evaluate your options, visit multiple properties, and ensure your selected home meets your long-term needs and budget constraints.

2. Don’t Overlook Additional Costs

Beyond the initial price, homeownership comes with numerous additional expenses. These include closing costs, property taxes, home insurance, maintenance, and unexpected repairs. Factor in these costs when budgeting to avoid financial strain and ensure you can conveniently afford your new home.

3. Don’t Ignore the Neighborhood

The neighborhood is as significant as the property you invest in. Investigate the area’s safety, schools, amenities, and future development plans. Visit at different times to gauge noise levels and traffic. A great house in a problematic neighborhood can affect your quality of life and the home’s future resale value.

4. Don’t Make Large Purchases Before Closing

Avoid significant financial changes before closing, such as buying a car or opening new credit lines. These actions can alter your credit score and debt-to-income ratio, potentially jeopardizing your mortgage approval. Lenders recheck your finances before finalizing the loan, so maintain financial stability until closing.

5. Don’t Skip the Final Walkthrough

A final walkthrough is essential to confirm the property’s condition before closing. Ensure agreed-upon repairs are complete, and check for new issues. This step helps avoid unpleasant surprises, ensuring that you are aware of any problems and can address them before finalizing the purchase.

6. Don’t Neglect Future Planning

Consider your long-term plans when purchasing a home. Think about family growth, career changes, and lifestyle needs. Choose a home that can adapt to future changes, ensuring it remains suitable and convenient as your circumstances evolve, thereby avoiding the need for another move too soon.

7. Don’t Forget to Negotiate

Negotiation is a critical aspect of home buying. Don’t accept the initial offer without attempting to negotiate the price, closing costs, or requested repairs. Skilled negotiation can save you money and secure better terms, making the purchase more financially favorable and suited to your needs.

Wrapping Up

Navigating the home-buying process can be challenging. However, if you are armed with the right information and have a clear strategy, it can also be one of the most rewarding experiences of your life. By following the dos and don’ts defined above, you can avoid the challenges and make informed decisions that will benefit you in the long run.

Remember to be patient, do thorough research, and leverage the expertise of professionals like real estate agents and mortgage advisors. Whether you’re a first-time homebuyer or a seasoned property owner, a thoughtful and methodical approach will help ensure that you find a home that not only meets your current needs but also serves as a sound investment for the future. Happy house hunting!

Business & Finance

Unlock Financial Freedom with Cash-Express: Your Go-To Online Lender

In today’s fast-paced world, unexpected expenses can strike at any moment, leaving you scrambling for a quick financial solution. Whether it’s a medical emergency, a car repair, or an opportunity you can’t afford to miss, finding a reliable and trustworthy online lender has never been more crucial. Enter Cash-Express – your ultimate destination for hassle-free legit online loans that empower you to take control of your financial situation.

Why Choose Cash-Express?

When it comes to online lending platforms, not all are created equal. Cash-Express stands out from the crowd, offering a seamless and transparent experience that puts your needs first. Here are the top reasons why you should choose this legit online platform for your next loan:

- Convenience at Your Fingertips: Say goodbye to the hassle of visiting physical lenders or navigating through endless paperwork. With Cash-Express, you can apply for a loan from the comfort of your home or on-the-go, thanks to their user-friendly online platform. No more wasting precious time in queues or juggling schedules – convenience is the name of the game.

- Lightning-Fast Approval Process: Time is money, and Cash-Express understands that. Their streamlined approval process ensures that you receive a decision on your loan application in record time. No more waiting for days or weeks to get the financial assistance you need – with Cash-Express, you can have the funds you require in your account faster than you can say “online loan.”

- Flexible Loan Options: Whether you need a small sum to tide you over until your next payday or a larger amount to tackle a more significant expense, Cash-Express has you covered. Their diverse range of loan options caters to various financial needs, ensuring that you can find a solution tailored to your unique circumstances.

- Competitive Interest Rates: Let’s face it – no one wants to pay exorbitant interest rates that eat into their hard-earned money. Cash-Express prides itself on offering competitive interest rates that won’t break the bank. Say goodbye to predatory lenders and hello to fair and transparent pricing that works in your favor.

- Excellent Customer Support: When it comes to managing your finances, having a reliable support system can make all the difference. Cash-Express boasts a dedicated team of knowledgeable and friendly customer service representatives who are always ready to assist you with any queries or concerns you may have. Their commitment to exceptional customer service ensures that your online lending experience is smooth and stress-free.

- Secure and Trustworthy Platform: In the digital age, privacy and security are paramount. Cash-Express understands this and has implemented robust security measures to safeguard your personal and financial information. With state-of-the-art encryption and strict data protection protocols, you can rest assured that your sensitive data is in safe hands.

Unleash Your Financial Potential with Cash-Express

Whether you’re facing an unexpected expense, seizing an exciting opportunity, or simply need a little breathing room until your next payday, Cash-Express is your trusted ally. With their commitment to convenience, speed, flexibility, affordability, and exceptional customer service, you can rest easy knowing that your financial needs are in capable hands.

So, why wait? Visit Cash-Express today and take the first step towards financial freedom. Unlock a world of possibilities and embrace the power of online lending with a legit platform that truly puts your interests first.

FAQs

Q: How do I apply for a loan on Cash-Express?

A: Applying for a loan on Cash-Express is a simple and straightforward process. Just visit their website, fill out the online application form with your personal and financial details, and submit your request. Their team will promptly review your application and get back to you with a decision.

Q: What documents do I need to provide for a loan application?

A: The required documents may vary depending on your specific loan type and amount, but typically, you’ll need to provide Passport, National ID, Driver’s licence, SSS, UMID, Postal ID, PRC ID. (Note that we need you to provide the picture of at least 1 of the 7 Mandatory IDs and selfie holding the same ID).

Q: How long does it take to receive the loan funds?

A: Once your loan application is approved, Cash-Express works diligently to transfer the funds to your designated bank account as quickly as possible. In most cases, you can expect to receive the loan amount from 15 minutes to 1 business day, allowing you to address your financial needs promptly.

Q: Can I repay my loan early without any penalties?

A: Absolutely! Cash-Express understands that financial situations can change, and they encourage their customers to repay their loans early if possible. They do not charge any prepayment penalties, so you can clear your debt ahead of schedule without incurring additional fees.

Q: Is Cash-Express a legitimate and trustworthy online lender?

A: Yes, Cash-Express is a fully licensed and regulated online lending platform that adheres to strict industry standards and best practices. They prioritize transparency, security, and customer satisfaction, ensuring that you can trust their services and feel confident in your decision to work with them.

-

Sports & Games5 years ago

Sports & Games5 years agoLet’s Dive Into To Know about Poe Ninja

-

News & Entertainment3 years ago

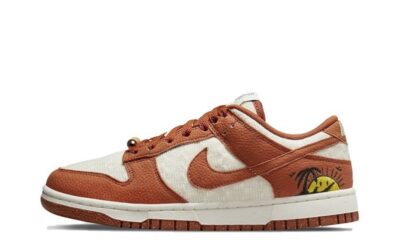

News & Entertainment3 years agoNike reps shoes

-

Business & Finance5 years ago

Business & Finance5 years agoLine Of Business

-

Sports & Games5 years ago

Sports & Games5 years agoIs a Toto site required for food verification?

-

Business & Finance5 years ago

Business & Finance5 years ago10 Best Online Platforms to Buy and Sell Cars in Karachi

-

Sports & Games5 years ago

Sports & Games5 years agoHow To Get Registered At Track Wrestling Forum

-

Sports & Games5 years ago

Sports & Games5 years agoHow will toto site help you find the best safe playground?

-

Business & Finance4 years ago

Business & Finance4 years agoHow does equity release work and what does it contain?